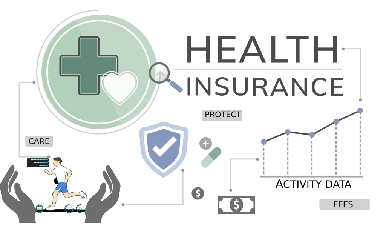

The traditional interviews with the clients are helpful, but do not provide adequate means to estimate the associated insurance risk and select the product best fitting the client. Real – world Date (RWD) of the client, continuously collected and assessed, can give insights on the client’s lifestyle, facilitating both initial product personalization and continuous product customization reflecting the client’s behavioral changes.

Insurance companies can be provided with a tool to better assess the risk involved in health insurance policies. This tool collects RWD from the clients, estimates the associated risk and allows the company to adjust the insurance fees to the lower risks associated with people with healthy lifestyles. This way insurance companies can offer targeted reduced fees, while keeping their risk at minimum.

The risk assessment process is automated, reducing the assessment costs of insurance companies. At the same time, the assessment burden to the client is minimized by the combined use of an activity tracker and a mobile app that collects the activity measurements and facilitates communication of client-reported information via questionnaires. This burden is undertaken on a volunteer basis and is well-justified by the expectation of lower insurance fees.

Pilot #12 of INFINITECH addresses this need on insurance companies utilizing Healthentia for the collection of RWD.

Healthentia (https://healthentia.com/) is originally designed as a system of collecting information from participants in clinical studies, that is now being repurposed for use in the insurance sector. Currently the pilot is adapting Healthentia to be used in a study with volunteers that will provide insight on the usability of the RWD collection system. The adaptations address both expanding the data collection device choices, and modifying the application to be used by the general population, outside its current clinical domain.